Sagewell Investment Advisors LLC

Investment Advisory Agreement

This Investment Advisory Agreement (“Agreement”) sets forth the understanding between Sagewell Investment Advisors LLC (the “Adviser”, “we”, or “us”), an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”) and you (“Client” or “you”), accessing and / or making use of the investment feature within the Sagewell website at www.sagewellfinancial.com or application (collectively, the “Sagewell Application”). This Agreement shall become effective whenever you accept by clicking through the online Advisory Agreement made available during the registration process which will signify your consent to the terms described in this Agreement. This Agreement concerns Client’s advisory account, managed by the Adviser on a non-discretionary basis and pursuant to Client’s authorization. If you have any questions about this Agreement, you should discuss them with us before executing.

To access the advisory services, Client must first become a registered user of the Sagewell Application.

The Adviser will provide Client with an investment recommendation via its online or mobile interactive questionnaire as described in its Form ADV Part 2 (“Brochure”). The recommended portfolio will be based upon Client’s stated objectives and risk profile at the time of the engagement as determined by your responses to to the client questionnaire included in the Sagewell Application (“Client Questionnaire”). The recommended model portfolios will be made up of exchange-traded funds (“ETFs”) managed by third-party SEC registered investment advisers and cash or cash equivalents. Client will select from such recommended model portfolios attached hereto as Schedule A. Client understands that information regarding Client’s specific circumstances that has not been communicated to or analyzed by the Adviser may impact the suitability of the recommendations provided to Client.

- Scope of Engagement

Client hereby appoints the Adviser as a non-discretionary investment adviser to perform the services hereinafter described, and the Adviser accepts such appointment.

- Adviser shall be responsible for reviewing and providing an assessment of your present level of financial objectives, goals, and risk tolerance based on Client’s responses to the Client Questionnaire and shall provide you with investment advice based on such responses in the form of recommended model portfolio(s). Pursuant to the Client’s selection of a portfolio / portfolios, the investment and reinvestment of those Client assets designated by Client are subject to Adviser’s management (which assets, together with all additions, substitutions and / or alterations thereto are hereinafter referred to as the “Assets” or “Account”);

- Client delegates to Adviser all of its powers with regard to the investment and reinvestment of the Assets consistent with the model portfolio(s) selected by Client, and appoints Adviser with limited power of attorney to buy, sell, or otherwise effect investment transactions involving the Assets in Client’s name and for Client’s Account consistent with such model portfolio(s);

- Adviser is authorized, without prior consultation with Client, to buy, sell, and trade in ETFs and cash or cash equivalents relating to the same, or

otherwise, and to give instructions in furtherance of such authority to the registered broker-dealer and the custodian of the Assets consistent with the model portfolio(s) selected by Client;

- Client delegates to the Adviser authority to retain one or more third party investment advisers to provide all or a portion of the discretionary management services with respect to the model portfolios. Adviser shall have sole discretion to hire and fire any third-party investment advisers that are providing such services without Client consent; and,

- Client agrees to provide information and/or documentation requested by Adviser in furtherance of this Agreement as it pertains to Client’s investment objectives, needs and goals, and to keep Adviser duly informed of any changes regarding the same. Client acknowledges that Adviser cannot adequately perform its services for Client unless Client diligently performs Client’s responsibilities under this Agreement. Adviser shall not be required to verify any information obtained from Client, Client’s attorney, accountant or other professionals, and is expressly authorized to rely thereon.

- You acknowledge and agree that Adviser will provide only limited investment advice described in this Agreement. You acknowledge and agree that, at this time, Adviser provides only limited advice and discrete investment options and delivers the services pursuant to the use of your Sagewell Application. You acknowledge and agree that while some personnel of Adviser who are knowledgeable about Client’s Account and its management will be available to Client for consultation, Adviser will generally not provide investment advice in person or over the phone, but will only provide investment advice through the Sagewell Application in accordance with this Agreement. You further acknowledge and agree that Adviser may in the future provide you with information regarding additional third-party services which you, in your sole discretion, may elect to participate in independently from the advisory services and you understand that Adviser does not endorse or warrant such third-party services by providing you with information related to such third-party service providers.

- Account Opening

Concurrent with the execution of this Agreement, Client has appointed DriveWealth LLC as its broker and custodian (“Broker” and “Custodian”) of the account assets and securities (the “Account”) and Securities pursuant to a separate “Carrying Agreement.” Adviser shall not be liable to Client for any act, conduct or omission by DriveWealth LLC and/or the clearing broker in its capacity as broker or custodian. At no time will Adviser accept, maintain possession or have custodial responsibility for Client’s assets or securities. Client assets and securities will be delivered between Client and Broker only.

The Account will be held at Broker’s carrying and clearing firm, on a fully disclosed basis. Upon Broker’s approval of the Account, Client must deposit at least the minimum investment amount into the Account in order to initiate discretionary management by Adviser. Recommended trades for Client’s selected portfolio will generally be placed within three business days to allow for account approval and fund processing. If the Account has not been funded within 60 days, Adviser may terminate the Agreement and request that Broker close the Account.

- Limited Account Authority

Generally, you will be responsible for the transfer of funds through the Sagewell Application by: (i) carefully reviewing the information about the investment options recommended by Adviser; (ii) carefully considering such recommendations that Adviser generates for you based on your stated financial goals, objectives, and risk tolerance; (iii) carefully choosing your personal goals and objectives; and (iv) providing Adviser with accurate personal financial information, goals and instructions through the questionnaire. Moreover, it is your responsibility to continually monitor the transfer of funds between your Checking Account and Account by using the Sagewell Application to initiate, schedule, automate, and monitor such funds transfers. However, Adviser shall have discretion over assets in your Account to the limited extent necessary for Adviser to manage deposits and withdrawals (and transfers between your Account and your Sagewell Checking Account) and to exercise securities trades according to your Client profile based on your responses to the questionnaire or pursuant to your request.

Given the possibility of liquidation, Client should consult a tax professional prior to depositing any securities in the Account. Client is solely responsible for any tax liabilities, fees, or third-party commissions (e.g., surrender fees, contingent deferred sales charges, etc.) triggered by such sales. Adviser will not charge any commission on any such sale.

Client may impose reasonable restrictions upon the management of the Account by requesting that Adviser reallocate to an alternative model portfolio in place of the current one. Adviser will not accept Client requests for restrictions that are inconsistent with Adviser’s stated investment strategy or philosophy or that are inconsistent with the nature or operation of Adviser’s investment advisory program.

Adviser may allocate a certain percentage of the Account to cash. This cash allocation is intended to ensure sufficient liquidity for payment of fees and expenses and to cover potential price changes when executing transactions. Broker may place cash balances that are either pending investment or specifically allocated to a cash on deposit at one or more banks.

- Account maintenance

The account must be funded once before advisory services will begin. Once initial funding is received, Adviser will manage the Account until a full withdrawal request is made by Client to liquidate and close the Account (“Termination of Services”). Any disbursement (Client-initiated withdrawal or liquidation, account statement/trade confirmation fee or other service provider fee) that would bring the Account to $0 will be processed as a full withdrawal. Adviser and the Broker hold full discretion to initiate the Termination of Services should the account balance be $0 for 2 consecutive months or more. Any subsequent deposit into the Account after Adviser initiates Termination of Services will not be automatically invested in your previously selected mode portfolio. Client is required to contact Adviser to reactivate the Account for investing.

Adviser holds full discretion to change the status of your investment account at any time, including an automated status change, with respect to placing an investing account on hold due to failure of an ACH payment. Account status changes may block the ability for funds to be invested whilst the account status is being reviewed by Adviser.

Withdrawal requests requiring the liquidation of securities will be processed after being received in good order and will be fulfilled after the settlement of such liquidating transactions.

- Broker and Custodian

Orders are routed for execution by Broker. Custodian will be the exclusive provider of custody services for all Account assets. Client will be required to establish a Sagewell Checking Account under a separate agreement (“Banking Agreement”) with Choice Financial Group through Sagewell Financial Inc., an affiliate of Adviser. The Banking Agreement provides Sagewell Financial Inc. with the ability to deposit and withdraw funds as necessary to provide the services elected by Client. As Sagewell Financial Inc. and Adviser are under common control, Adviser will be deemed to have custody over Client’s Account. As such, Adviser will engage an independent auditor that is registered with the Public Company Accounting Oversight Board (PCAOB) to conduct surprise annual audits of the Account. Fees associated with the surprise annual audit, as well as all other fees imposed on Client by Adviser that are in addition to Adviser fees are described in more detail below under Section 8 of this Agreement. By executing this Agreement, Client consents to, and authorizes, such additional fees. In addition to the surprise annual audit, Client will have access to real time reporting on the transactions in the Account via the Sagewell Application and will receive at least quarterly statements from Adviser and Custodian.

You may request that Adviser make transfers between your Sagewell checking account and your Account, subject to any maintenance requirements of Custodian. You should allow up to 5 business days for Adviser to process the instructions you have provided and for the funds transfers to be processed.

- Account Connections

In order to make use of Adviser’s investment advisory services, you will be required to connect your Account to your Sagewell Checking Account by providing true, accurate, current, and complete Sagewell Checking Account credentials. You acknowledge and agree that your Account will not be connected to your Sagewell Checking Account unless and until Adviser receives confirmation through the Sagewell Application that you have successfully connected your Account and Sagewell Checking Account. You further agree that, if your Sagewell Checking Account is temporarily closed or restricted after it is successfully connected to your Invest Account, you will have no right under this Advisory Agreement or the Terms of Service to transfer funds between your Sagewell Checking Account or Account through the Sagewell Application until: (i) your Sagewell Checking Account is reopened or unrestricted; or (ii) you have successfully connected an alternative checking account to your Account. If your Sagewell Checking Account is permanently closed for any reason, Adviser reserves the right to close your Account and direct the Custodian to sell all securities registered in your name through the Sagewell Application and remit the sales proceeds to you after paying any past due fees under this Agreement.

- Prospectuses

All investments in ETFs are subject to the terms of the relevant prospectus, including associated fees, if any. An electronic notice will be sent to you via the email address you have provided when prospectuses are available for your review. You acknowledge that it is your responsibility to read all prospectuses upon receipt of such notice and to notify us immediately of any terms of the prospectuses that are not acceptable to you.

- Fees

Adviser will charge Client a subscription-based fee of $360 per year (“Advisory Fee”) in connection with its investment advisory services. Such fee is inclusive of all brokerage and transaction fees associated with the investing and rebalancing of the Account. The Advisory Fee will be charged monthly in advance at a rate of 1/12 of the annual fee. Adviser will directly debit the Advisory Fee from Client’s Sagewell Checking Account.

As described in Section 5 above, Client shall separately incur fees in connection with the actual cost of an annual surprise examination of a Client account by a PCAOB registered accountant up to $5,000. Client will also incur all fees and expenses charged by Broker / Custodian related to the establishment, maintenance, and termination of the Account, including any returned check and wire fees, telephone assisted trading fees, fees for hard copy trade confirmation and account statements, tax document fees, all charges associated with electronic asset transfers into or out of the Account. Client should review the Carrying Agreement to view the full schedule of Broker / Custodian fees.

- Directions to Adviser

All directions by Client to Adviser (including notices, instructions, directions relating to changes in the Client’s investment objectives) shall be in writing, via email, the Sagewell Application, or by phone at 617-397-3764. Adviser shall be fully protected in relying upon any such direction, notice, or instruction until it has been duly advised in writing of changes therein.

- Termination of Services

Either party may terminate this Agreement at any time by sending a 15-day written termination notice to the other party. Upon delivery of a termination notice to Client, receipt of a termination notice from Client, or a transaction that brings the Account in arrears, or as described in Section 4, Adviser will liquidate all Account positions and cease providing all services contemplated by this Agreement. Adviser will inform Broker that the relationship between Adviser and Client has been terminated, and Broker will close Client’s Account. Upon termination, Adviser will provide a refund of the prorated amount of the Advisory Fee not earned within two quarters from the date of termination.

If at any time Adviser receives or develops information indicating that Client no longer resides in the United States, Broker may restrict, or Adviser may request that Broker restrict the Account. Client may provide, or be asked by Adviser to provide, documentation in support of a claim of continued permanent residency in the United States for the purpose of lifting such restriction. However, if the restriction is not resolved within 60 days, Adviser may liquidate all Account positions, terminate this Agreement and notify the Broker.

- Assignment and Modification

This Agreement may not be assigned (within the meaning of the Investment Advisers Act of 1940 (the “Advisers Act”) by either Client or Adviser without the prior written consent of the other party. Client acknowledges and agrees that transactions that do not result in a change of actual control or management of Adviser shall not be considered an assignment pursuant to Rule 202(a)(1)-1 under the Advisers Act.

Unless expressly stated otherwise, no provision of this Agreement or any of the documents referred to herein may be amended, modified, supplemented, changed, waived, discharged or terminated, except by a writing signed by each party hereto. No failure by Adviser or Client to exercise any right, power, or privilege that Adviser or Client may have under this Agreement shall operate as a waiver thereof.

- Non-Exclusive Management

Adviser, its officers, employees, and agents, may have or take the same or similar positions in specific investments for their own accounts, or for the accounts of other clients, as Adviser does for the Account. Client expressly acknowledges and understands that Adviser shall be free to render investment advice to others and that Adviser does not make its portfolio management services available exclusively to Client. Nothing in this Agreement shall impose upon Adviser any obligation to purchase or sell, or to recommend for purchase or sale, for the Account any security which the Adviser, its principals, affiliates or employees, may purchase or sell for their own accounts or for the account of any other Client.

- Adviser Representations

Adviser warrants, represents, and agrees to each of the following:

- Adviser is registered with the U.S. Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Adviser is also in compliance with the notice-filing requirements of each jurisdiction in which it conducts investment advisory business.

- Adviser will provide investment advisory services in a manner consistent with its fiduciary duties and the provisions of all applicable laws, including the Advisers Act.

- Client Representations

Client warrants, represents, and agrees to each of the following:

- If Client is a natural person, Client is a legal permanent resident of, and resides full-time in, the United States and has the capacity to enter into and perform this Agreement, provided, that Client may reside outside the United States if Client is active military stationed abroad.

- If Client is not a natural person, Client certifies that: (i) it is validly organized under the laws of an applicable jurisdiction within the United States; and (ii) the person signing this Agreement has full and complete authority to execute this Agreement on behalf of Client.

- The terms of this Agreement do not violate any obligations of Client, whether arising by contract, operation of law, or otherwise.

- Client owns all property deposited at any time in the Account free and clear of any lien or encumbrance and no restriction exists as to any disposition of such property.

- Client has received and agreed to receive information electronically and use electronic signatures.

- Client will maintain a current, function e-mail address and will notify Adviser immediately if an e-mail address or any other contact information changes.

- Regardless of whether Adviser sends Client a separate notification via e-mail, Client is responsible for regularly reviewing the Sagewell Application for Account-related communications, including but not limited to time-sensitive communications, and Client agrees to be bound by the terms of such communications.

- Client has received Adviser’s Brochure, which describes the roles and capacities of Adviser and its representatives and discloses any material conflicts that may exist. Client acknowledges that: Adviser (i) performs services for other clients; (ii) may make recommendations to other clients that differ from recommendations made to Client; and (iii) is not obligated to recommend to Client for purchase or sale any security or other asset recommended to any other client.

- Client has received Adviser’s Form ADV Part 3.

- Client has received Adviser privacy notice.

- Confidentiality of Information

Adviser agrees to keep Client’s financial and personally identifiable information confidential and will not disclose such information except as permitted by Adviser’s privacy notice.

- Death or Disability

The death or incapacity of the Client shall not terminate the authority of Adviser granted herein until we receive actual notice of such death or incapacity. Upon such notice, your executor, guardian, attorney-in-fact or other authorized representative must engage Adviser in order for us to continue to service or terminate your Account.

- Arbitration

Subject to the conditions and exceptions noted below, and to the extent not inconsistent with applicable law, in the event of any dispute pertaining to Adviser’s services under this Agreement, both Adviser and Client agree to submit the dispute to arbitration in accordance with the auspices and rules of the American Arbitration Association (“AAA”), provided that the AAA accepts jurisdiction. Adviser and Client understand that such arbitration shall be final and binding, and that by agreeing to arbitration, both Adviser and Client are waiving their respective rights to seek remedies in court, including the right to a jury trial. Client acknowledges and agrees that in the specific event of non-payment of any portion of Adviser compensation, Adviser, in addition to the aforementioned arbitration remedy, shall be free to pursue all other legal remedies available to it under law, and shall be entitled to reimbursement of reasonable attorneys fees and other costs of collection.

Client understands that this Agreement to arbitrate does not constitute a waiver of Client’s right to seek a judicial forum where such waiver would be void under federal or applicable state securities laws.

- Limitation of Liability

Client understands and agrees with the following:

- Adviser obtains information from a wide variety of publicly available sources and does not guarantee the accuracy of any such information or the success of any advice predicated thereon;

- Adviser does not and will not practice law or offer tax or accounting services to Client. None of the services offered under this Agreement relate to such services and Client must obtain such advice from a third party if desired. Any tax information provided by Adviser is not a substitute for the advice of a qualified tax advisor.

- Adviser’s communications are intended to provide Client with general information that may be useful to Client’s own investment decisions. This general information does not address the details of Client’s personal situation, and it is not intended to be an individualized recommendation that Client take any particular action;

- Neither Adviser nor its officers, directors, employees, or affiliates (each, an “Adviser Party”) will be liable for any loss incurred as a result of the services provided to Client by Broker or Custodian via Client’s instructions;

- All investments involve risk, and some investment decisions may result in losses, including loss of principal. Adviser does not warrant or guarantee that Client’s investment objectives will be achieved; and

- No Adviser Party will be liable for any loss incurred in the Account unless such loss results from such Adviser Party’s negligence or misconduct. Notwithstanding the foregoing, nothing contained in this Agreement shall constitute a waiver by Client of any rights under applicable federal or state securities laws including, without limitation, the Advisers Act.

- Consent to Electronic Delivery of Account Information and Documents and Use of Electronic Signatures

Client consents to the receipt of all Account-related information and documents in electronic form and to the use of electronic signatures in connection with any transaction with Adviser. Client has received and read, understands, and agrees to the terms. Client understands that if Client withdraws such consent, the Account may be terminated. By electronically signing an application for an account, Client acknowledges and agrees that such electronic signature is valid evidence of Client’s consent to be legally bound by this Agreement and such subsequent terms as may govern the use of Adviser’s services. Client accepts notice by electronic means as reasonable and proper notice, for the purpose of any and all laws, rules and regulations. The electronically stored copy of this Agreement is considered to be the true, complete, valid, authentic, and enforceable record of the Agreement, admissible in judicial or administrative proceedings to the same extent as if the documents and records were originally generated and maintained in printed form. Client agrees to not contest the admissibility or enforceability of Adviser’s electronically stored copy of the Agreement. Unless otherwise required by law, Adviser reserves the right to post Account-related information and documents on its website without providing notice to Client. Further, Adviser reserves the right to send Account-related information and documents to Client’s postal or e-mail address of record.

Client agrees that delivery by any of the foregoing methods is considered personal delivery when sent or posted by Adviser, whether Client receives it or not.

All e-mail notifications regarding the Account will be sent to Client’s e-mail address of record. Regardless of whether Client receives an e-mail notification, Client agrees that Client is responsible for regularly reviewing the Adviser website for information related to the Account including, without limitation, time-sensitive or otherwise important communications. Additionally, Client acknowledges that the Internet is not a secure network and agrees that Client will not send any confidential information including, without limitation, account numbers or passwords, in any unencrypted e-mails. Client also understands that communications transmitted over the Internet may be accessed by unauthorized or unintended third parties and agrees to hold Adviser and its affiliates harmless for any such access, subject to any rights Client may have under applicable law.

Client agrees to carefully review all documents upon receipt and notify Adviser in writing of any objections within 15 business days of receipt.

- Costs

Potential costs associated with electronic delivery of Account-related information and documents may include charges from internet access providers and telephone companies, and Client agrees to bear these costs. Client acknowledges that Client may be charged for paper communications if the Client’s e-mail address is invalid or otherwise inoperable.

- Hardware and Software Requirements

Client understands that in order to receive electronic disclosures and communications, Client must have access to a computer or mobile device with Internet access, a valid e-mail address, and the ability to download such applications as Adviser may specify and to which Client has access. Client also understands that if Client wishes to download, print, or save any information Client wishes to retain, Client must have access to a printer or other device in order to do so. Client understands that the foregoing provisions will be effective when Client creates an online account on the Sagewell Application and consents to do business electronically with Adviser.

- Archiving

Upon Client’s request, or via the Sagewell Application, Client may obtain copies of earlier documents for up to 6 years for account statements and 6 years for trade confirmations.

Severability

Any term or provision of this Agreement that is held invalid or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the

extent of such invalidity or unenforceability without rendering invalid or unenforceable the remaining terms or provisions of this Agreement or

affecting the validity or enforceability of any of the terms or provisions of this Agreement in any other jurisdiction.

- Governing Law

To the extent not inconsistent with applicable law, this Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

- Receipt of Disclosures

Client hereby acknowledges receipt of Adviser’s Privacy Policy Notice and a copy of Adviser’s written disclosure statement as set forth on Part 2 and 3 of Form ADV (Uniform Application for Investment Adviser Registration) or otherwise meeting the requirements of Rule 204-3 of the Advisers Act, and/or applicable state law.

Schedule A

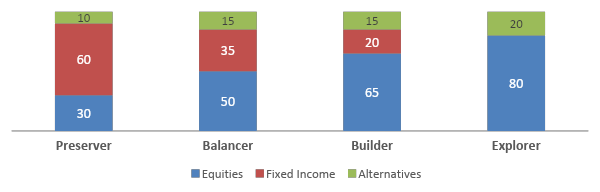

Model Portfolio Asset Allocation

Model Portfolio Descriptions

Preserver

Preservers place a great deal of emphasis on financial security. Their investments often support

their lifestyle. Preservers have to be careful of making sure investment growth can match or

exceed their withdrawals to keep the account intact. Risk management is of primary importance

for Preservers and they are willing to accept low returns in exchange for safety of principal.

Preservers are prone to emotional decision making given their emphasis on avoiding losses.

This can be especially problematic during a time of large market declines. Therefore, Preservers

benefit most from a proactive risk management strategy where they are more defensive when

market risk is high and more growth oriented if market risks are low.

Balancer

Balancers are often in or close to retirement. They have worked for a long time and built a nest

egg of investment savings. Balancers will need to draw income from this nest egg in retirement

to supplement their pension or Social Security (in case of medical needs or to help a child). Due

to longer life expectancy, Balancers often need to continue to grow their investment savings

while balancing risk.

The biggest risk for the Balancer is a major stock market drawdown. Since they are often taking

withdrawals and may no longer be working, their accounts will have a difficult time recovering.

Therefore, Balancers are much more aware of risk management with their investments.

Builder

Builders are concerned with growing their wealth. Most of their investment savings are in

retirement accounts, like a 401k or IRA, and they are not taking withdrawals unless required.

Builders have plenty of savings to tolerate downturns in the market due to recessions; but often

they look for guidance in helping them manage risk. Given their long-time horizon and net worth,

Builders have the opportunity to take more risk. Still, they prefer to manage risk prudently, as

their investments could have an influence on their standard of living later in their life. Builders

can have a wide range of investment experience, but generally understand that investment

markets go up and down given what is going on in the world. Declines in the market can be

seen as opportunities to buy more at lower prices.

Explorer

Explorers are very comfortable taking risks and view the stock market as a means to increase

their wealth by large amounts. Explorers tend to be on opposite ends of the wealth spectrum.

Those who have more wealth than they need to support their lifestyle will open a “play money”

account. They know losing this money will not affect their lifestyle in a meaningful way, so they

are open to taking on a high degree of risk in hopes of high returns. On the other end of the

spectrum, some Explorers have a very small amount of money to invest. Again, losing this

money would not dramatically affect their financial situation, so they are willing to assume a high

degree of risk in hopes of building their investments faster.